best canadian stocks to sell covered calls

The BMO Covered Call Canadian Banks ETF yields about 66 per cent and charges a management expense ratio of 071 per cent. Right now the best ones are ones like AC where its super volatile or reits which have huge dividend payment.

Best Canadian Stocks For Covered Calls Nbdb

Global X Dow 30 Covered Call ETF -277 PUTW.

. Global X NASDAQ 100 Covered Call Growth ETF NASDAQ. Best Wheel Stocks Under 10 Wheel Strategy. Manufactures automobiles under its Ford and Lincoln brands.

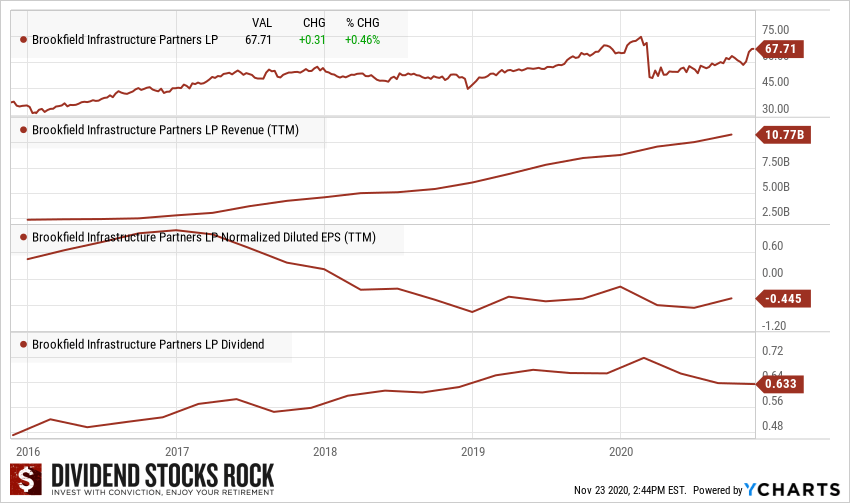

In exchange for this 100 premium the investor agrees to sell her shares at 35 if the holder of the call option exercises it. In March 2022 the company announced that it will run. Procter Gamble Pembina Pipeline Brookfield Infrastructure Partners Fortis Inc.

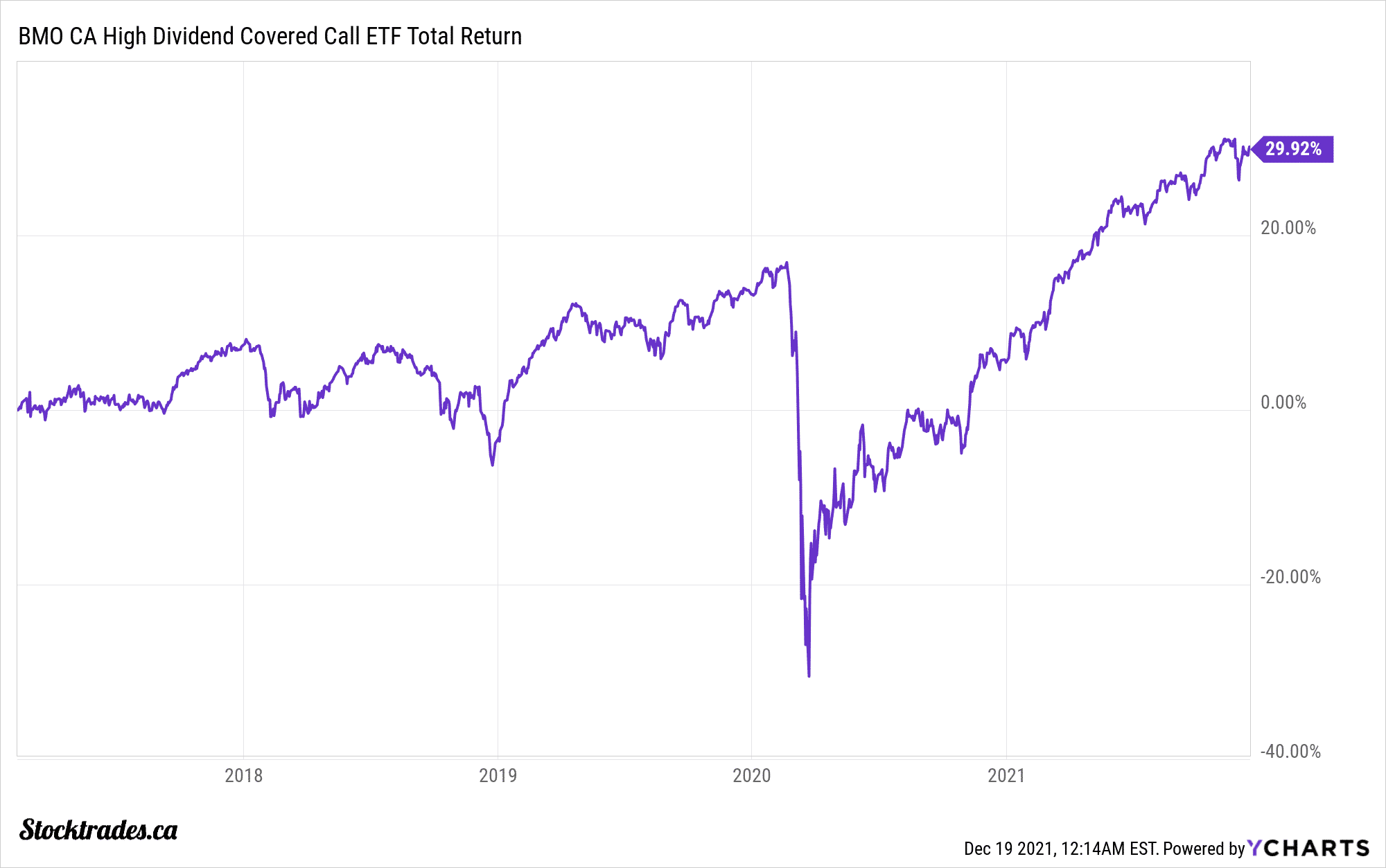

The Canadian covered call bank ETF by BMO serves a simple purpose. BMO Canadian High Dividend Covered Call ETF ZWC 3. A Covered Call or buy-write strategy is used to increase returns on long positions by selling call options in an underlying security you own.

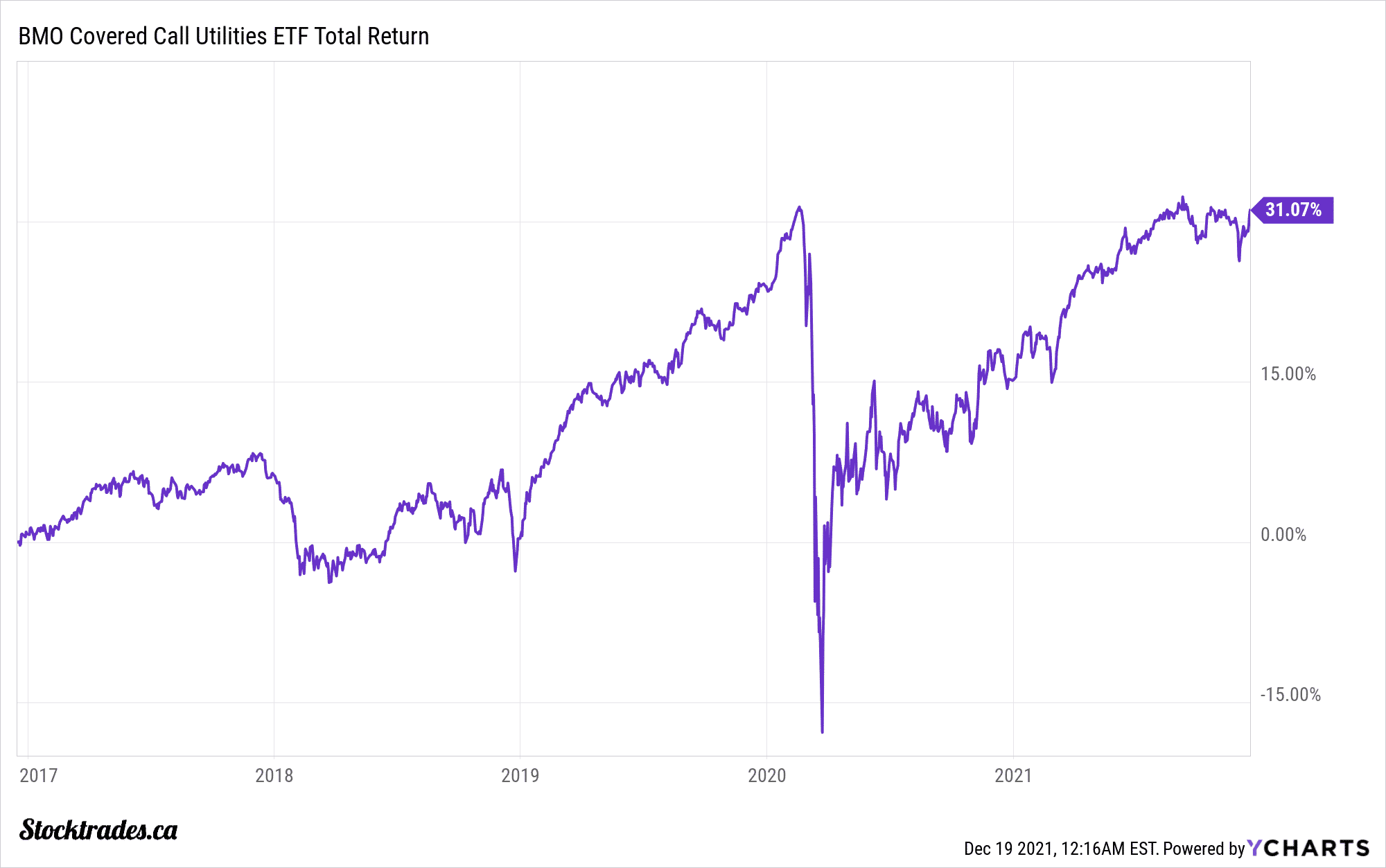

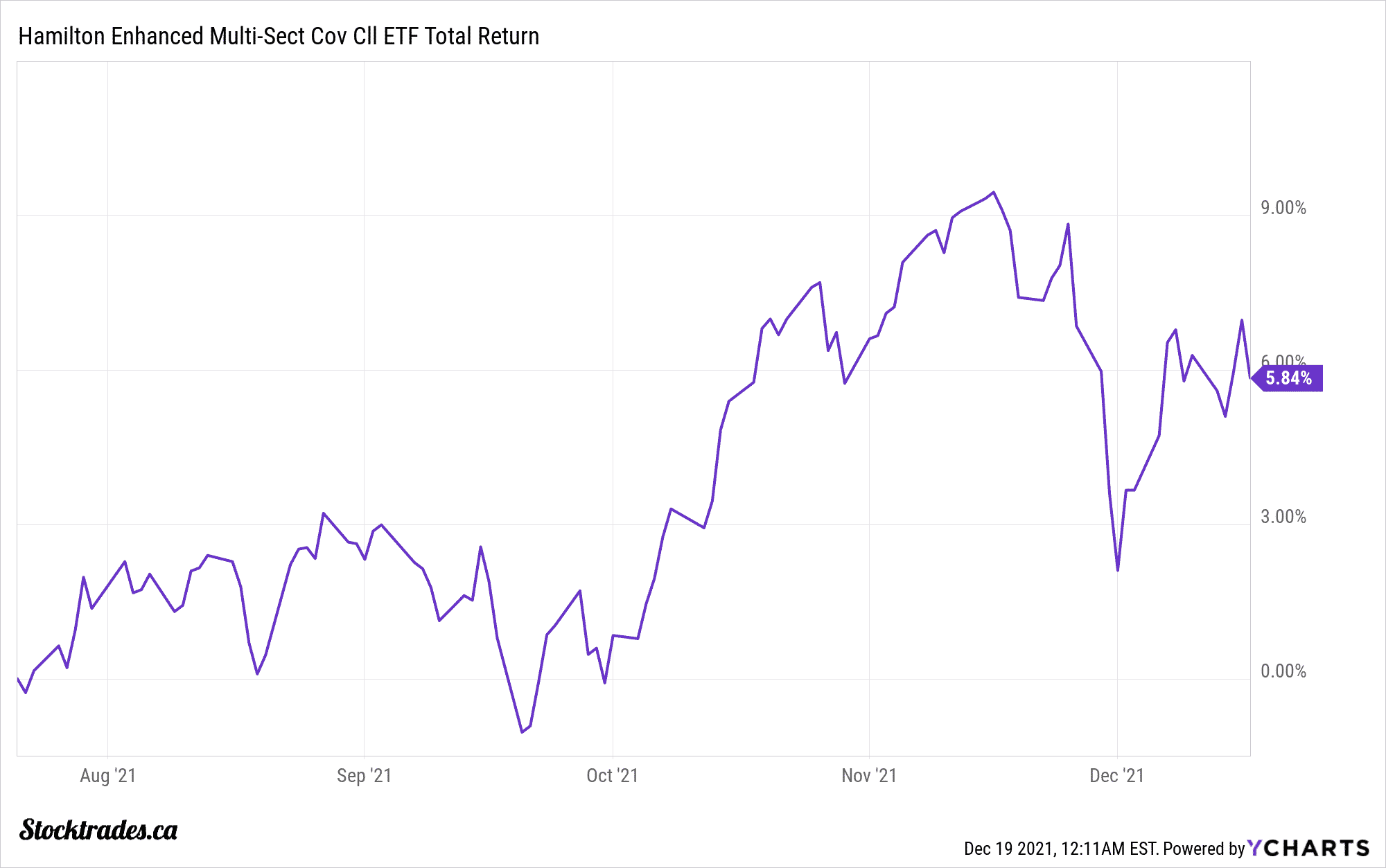

Lets have a closer look at one of the more popular Covered Call ETFs in Canada ZWB which has been around since 2011. Best Covered Call ETFs In Canada. In Canada some top dividend stocks include.

In Canada some top dividend stocks include. Ad 874 Proven Accuracy. Selling call options helps produce a flow of income yielding anywhere from 5 to 13 per cent which beats the typical blue-chip income stock or.

It may also be referred to as call writing. Some good etfs to sell covered calls on. WMT Acadia Healthcare Co NASDAQ.

It will give investors exposure to all of the 6 major Canadian banks including the likes of Royal Bank TD Bank and even National Bank. For example lets say that the XYZ Zipper Company paid a 050share dividend on June 1. The pink with 173 is NA National Bank the Purple and light blue is TD and BMO with around 120 return and the blue colour at the bottom with 36 is ZWB the BMO Covered Call Canadian Banks ETF.

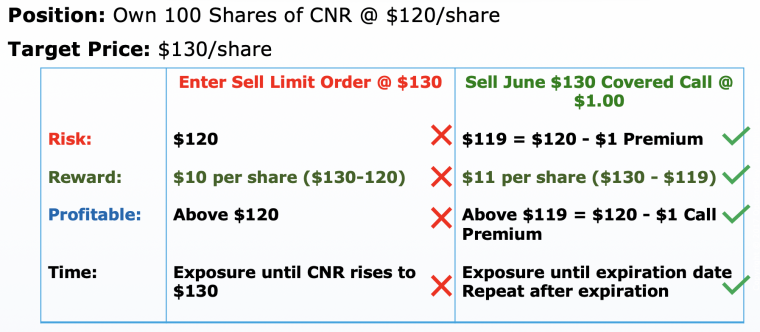

There are two steps required for an investor to execute this strategy owning a minimum of 100 shares of a stock and writing a call option against it. Deciding you want to sell covered calls and picking a stock to do it is ass backwards. When selling covered calls I.

Pick a stock you like then look to see if selling covered calls makes sense. Slightly more expensive for option trading than Questrade but better service. The ETF will then sell covered call options on those stocks to generate income for its unit holders.

Covered calls 101 my simple explanation. CI First Asset Health Care Giants Covered Call. This makes OPKO a.

Polaris Infrastructure KevelPitch Check back here for the most up. In this case the effective selling price will then be 36share the strike price of 35 the 1 premium. Procter Gamble Pembina Pipeline Brookfield Infrastructure Partners Fortis Inc.

BMO Covered Call Technology ETF ZWT 4. The call option is written for 100 per share for a total of 100 100 per share x 100 shares per option. Ive never done covered calls before so any other advice is appreciated.

The best times to sell covered calls are. XOM EXXON MOBIL CORPORATION In our first covered call example XOM has trade between 72 and 88 over the past two years and is currently in the middle of that zone around 80. 2 For slow growth companies so you can maximize your returns from a combination of dividends.

125 per contract995 Min. Best Stocks for Covered Calls. And then selling covered calls on the 100 shares that you own.

Stay ahead w powerful tools specialized support and competitive margin rates. Long Iron Condors. 30 a period when the coronavirus hammered.

Stocks options futures trading. Polaris Infrastructure KevelPitch Check back here for the most up. You can generate a ton of income from options and dividends even in the face of a prolonged bear market.

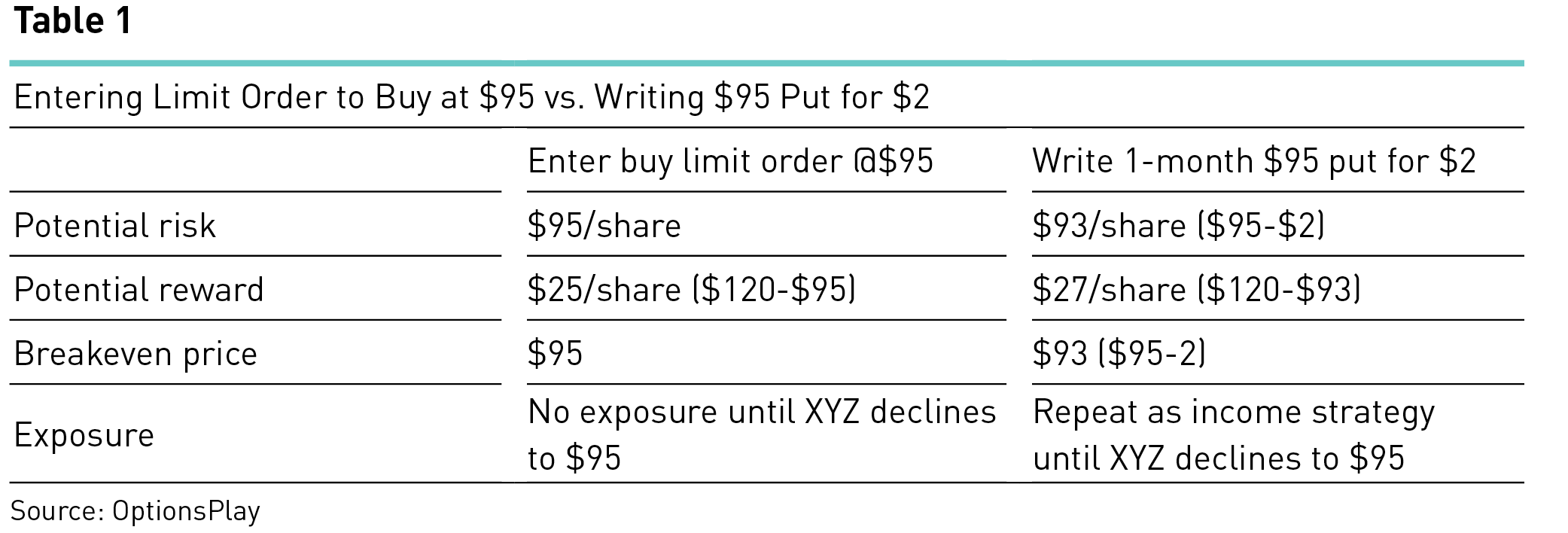

BMO Covered Call Canadian Banks ETF ZWB Here are the key facts and figures for BMO Covered Call Canadian Banks ETF. But you should be aware that dividends do play a role in call option pricing. A covered call is a two-part buy-write options strategy in which a stock is purchased or owned and calls are sold on a share-for-share basis.

Lots of stocks even REITs but its not really a big premium would offer both a dividend and chance to sell. 1 During periods of market overvaluation where the market is likely to be flat or down for a while. Ideally cheap price-per-share under 20 cad and good liquidity since i have to hold 100 shares.

Now instead of doing this with stocks covered call ETFs sell or write call options on a. Overbought stocks you want to collect income on but would prefer to keep and anticipate a fair chance that the stock falls a bit letting the call expire. Credit Suisse X-Links Gold Shares Covered Call ETN -223 DJIA.

F Ford Motor Co. Credit Suisse X-Links Crude Oil Shares Covered Call ETN 073 GLDI. Profit is limited to strike price of the short call option minus the purchase price of the underlying security plus the premium.

Best broker overall in Canada. Once a stock is acquired at a discount using cash-secured puts a covered call can further enhance this equity position by generating an income stream while holding the asset. Our 40 Years Of Experience Speaks For Itself.

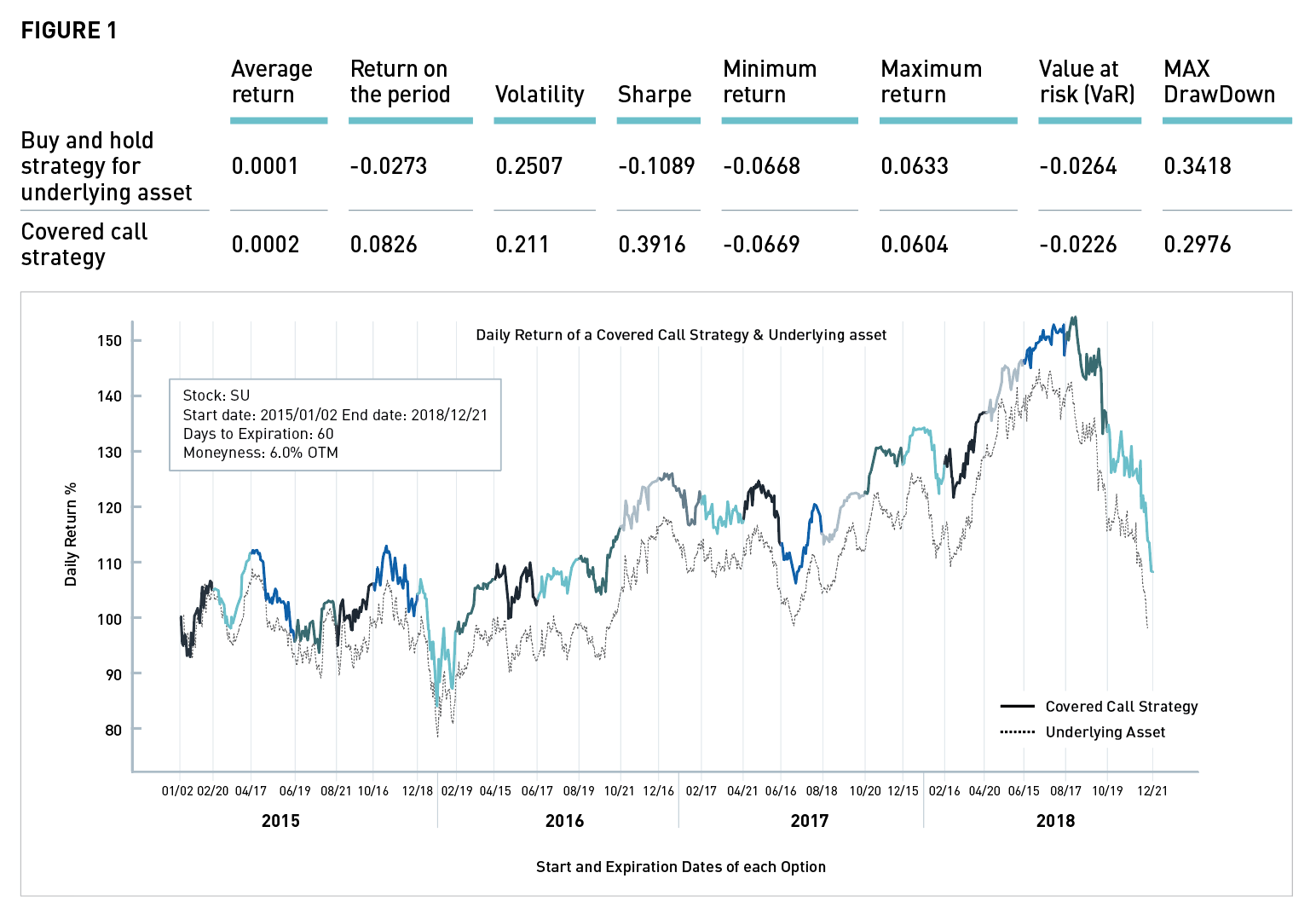

These are two dividend stock examples that are some of the best stocks to write covered calls against. Over the past five years the covered call ETFs have earned roughly half the return of the underlying index - 95 annualized for XYLD. Dividends are a plus.

Ad OptionsHouse is now Power ETRADE. Experience the Power of Artificial Intelligence. QYLG an ETF investing in American public equity markets is next on our list of monthly dividend covered call ETFs and ETNs you can count on.

In theory on the day a company pays a dividend the stock should trade lower by the amount of the dividend because that money is no longer owned or controlled by the company.

The Best High Yielding Etfs In Canada For Passive Income Stocktrades

Covered Call Etfs Here S Why New Investors Should Avoid Them

The Best High Yielding Etfs In Canada For Passive Income Stocktrades

Zwb Vs Zwu Which Covered Call Etf Is The Better Buy For Canadian Investors The Motley Fool Canada

Best Canadian Utilities My Top 4 Seeking Alpha

Best Canadian Stocks For Covered Calls Nbdb

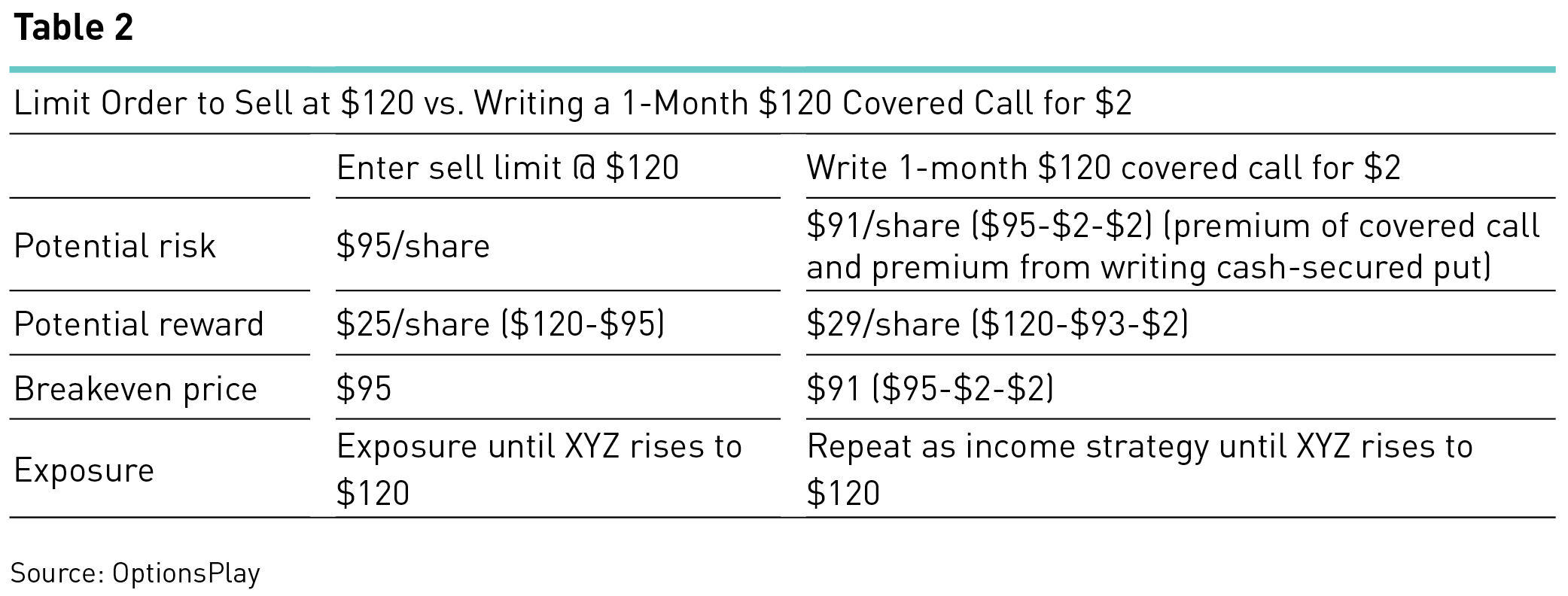

Covered Calls Managing Risk Exposure And Generating Value During Volatile Times Option Matters

9 Best Covered Call Etfs In Canada 2022 Simplify A Complex Strategy

Covered Call Etfs In Canada Good For Retirees Genymoney Ca

Make Monthly Income Selling Covered Calls Canadian Passive Income Youtube

Zwc Vs Zwh Which Covered Call Etf Is The Better Buy For Canadian Investors The Motley Fool Canada

Best Canadian Stocks For Covered Calls Nbdb

The Best High Yielding Etfs In Canada For Passive Income Stocktrades

The Best High Yield Stocks In Canada 2022

9 Best Covered Call Etfs In Canada 2022 Simplify A Complex Strategy

Best Canadian Stocks For Covered Calls Nbdb

Zwc Vs Zwh Which Covered Call Etf Is The Better Buy For Canadian Investors The Motley Fool Canada

9 Best Covered Call Etfs In Canada 2022 Simplify A Complex Strategy

The Definitive And Practical Guide To Selling Covered Calls Option Matters